Best Free Zones in Oman for Company Formation

Are you wondering why more foreign investors are heading to Oman instead of the usual destinations in the region? If you’re a businessperson looking to expand in the Gulf, Oman’s free zones may be your next big opportunity. You might be tired of bureaucratic red tape, high operational costs, or slow setup times in other countries. Or perhaps you’re looking for full foreign ownership, tax savings, and a simpler process to start your company.

This is where Oman’s best free zones stand out, offering a unique investment environment that balances competitive advantages with government support.

Why is Oman Catching Global Attention for Business Setup?

Oman isn’t just another Gulf country; its geographical location is strategic and ideal for global logistics. Its government is known for being investor-friendly and has made significant strides in simplifying procedures. Oman also ranks well in regional ease of doing business indices. Oman’s free zones provide several essential benefits for businesses, including:

- Tax Holidays: Zero corporate and personal income tax for long periods (10-25 years).

- 100% Foreign Ownership: No need for a local sponsor.

- No Minimum Capital Requirements: In most zones and activities.

- Fast-tracked Business Licensing: Significantly faster procedures than mainland setup.

Let’s take a deep dive into the key aspects that make company formation in Oman’s Free Zones a practical and powerful option for your business.

Free Zones in Oman: What Makes Them Different?

Oman’s free zones are distinguished as business-friendly environments, making the business setup process in Oman smoother by providing tailored legal frameworks and regulations. This means fewer approvals, quicker registrations, and simplified licensing.

Top Free Zones in Oman for Foreign Investors:

- Salalah Free Zone: Perfect for logistics and shipping due to its proximity to the deep seaport, encouraging processing industries and re-export services.

- Sohar Free Zone: Known for heavy manufacturing, petrochemicals, and metals industries, offering robust energy and water infrastructure.

- Al Mazunah Free Zone: Best suited for trade with Yemen and Africa, offering special incentives for cross-border trade.

- Knowledge Oasis Muscat (KOM): A hub for technology, innovation, and startups in the ICT sector.

- Khazaen Economic City: A modern integrated economic zone focusing on logistics, light industries, warehousing, and offering promising opportunities in diverse sectors.

These zones are designed with international trade, manufacturing, and knowledge-based sectors in mind. If your goal is to start a business in Oman’s Free Zones, this flexibility is your true friend.

By the end of 2024, the total workforce in Oman’s economic zones reached approximately 78,000, with 29,000 Omani citizens employed, demonstrating growing local support and robust business activity.

Oman Free Zone Company Formation: Practical Advantages

Setting up a company in an Omani free zone offers you several substantial benefits that enhance success and profitability:

- 100% Foreign Ownership: Eliminates the need for a local sponsor or partner, granting foreign investors full control over their businesses.

- Comprehensive Tax Exemptions: Zero corporate and personal income tax for periods ranging from 10 to 25 years, significantly boosting profitability.

- Import/Export Benefits: Duty-free operations across GCC markets, which is ideal for businesses relying on import and export.

- Full Repatriation of Profits: Complete freedom to transfer profits and capital back to your home country easily and without restrictions.

- No Currency Restrictions: Freedom to operate in any currency you prefer, providing financial flexibility.

- Quick and Efficient Licensing: The process of obtaining a license is significantly faster than mainland setup, reducing start-up time.

- No Minimum Capital Requirements: In most zones and activities, reducing the initial financial burden on investors.

- Flexible Office Requirements: Generally, company formation in Oman’s Free Zones does not require a physical office in the beginning, making it even more attractive for startups and small businesses.

The appeal is clear: business setup in Oman within free zones removes many of the traditional roadblocks that delay success.

Best Business Types for Oman’s Free Zones

Oman targets specific sectors to support its Vision 2040 strategy and economic diversification. Therefore, company formation in Oman’s Free Zones is ideal for businesses falling within the following sectors:

- Manufacturing and assembly

- Logistics and warehousing

- ICT and telecom

- Renewable energy

- Pharmaceuticals

- Food processing

- Research and Development (R&D)

These zones are designed to attract industries that support Oman’s long-term economic goals, making company formation in Oman’s Free Zones an ideal choice for export-oriented and technology-driven businesses.

Oman Business License in Free Zones: Step-by-Step Process

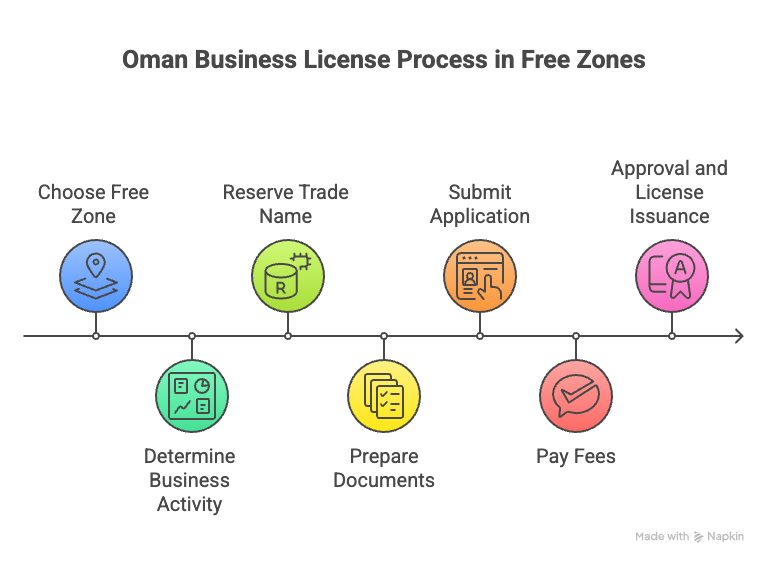

Obtaining a business license in Oman’s Free Zones is relatively straightforward and streamlined. Here are the essential steps:

- Choose the Right Free Zone: Based on your business activity and goals (Salalah, Sohar, Al Mazunah, Knowledge Oasis Muscat, Khazaen, etc.).

- Determine Business Activity and License Type: Identify the category your business falls under (e.g., trading, service, industrial).

- Reserve a Trade Name: Check for name availability and register it.

- Prepare Required Documents:

- Business Plan.

- Copies of passports for shareholders and managers.

- Proof of address.

- Copy of CV for the manager.

- No Objection Certificate (NOC) if the applicant is employed in Oman.

- Power of Attorney if applying through an agent.

- Submit the Application: The application is submitted through the relevant Free Zone’s online portal.

- Pay Fees: Pay application and licensing fees.

- Approval and License Issuance: After examination and approval, the business license is issued.

The entire process typically takes around 7 to 10 working days in most Free Zones, significantly accelerating the business launch process. Oman business licenses in Free Zones also allow for multi-year renewals, reducing annual compliance stress.

Comparison of Top Free Zones in Oman for Foreign Investors

Here’s a quick comparison of major free zones in Oman to help you choose the right fit:

Salalah Free Zone: Perfect for logistics and shipping due to its port proximity.

Sohar Free Zone: Known for manufacturing and petrochemical industries.

Al Mazunah Free Zone: Best suited for trade with Yemen and Africa.

Knowledge Oasis Muscat (KOM): Technology and startups hub.

Each of these zones supports Oman business license in free zones with tailor-made services depending on your industry.

How Can Jitendra Trademark and Patent Services Make It Easier?

Starting a business overseas can be confusing, especially with varying laws and regulations. If paperwork, legal norms, or compliance worries you, you’re not alone. Many first-time investors hesitate because they don’t fully understand the system.

This is where Jitendra Trademark and Patent Services (JTP) helps. We simplify the entire Oman business setup process for you. From choosing the best free zone that suits your needs to obtaining your license and opening your bank account, we handle it all from A to Z. We are experts in Oman free zone company formation and have helped hundreds of businesses make a successful start.

We offer end-to-end assistance, including:

- Company registration

- Legal document drafting

- PRO Services

- Specialized legal advisory

- Ongoing compliance support

If you’re ready to take your next step and want to start a business in Oman’s Free Zones, let’s talk. We’ll help you make your Oman dream a reality, without the stress and with full clarity.

Frequently Asked Questions (FAQ)

What are the main advantages of company formation in an Oman Free Zone?

Key advantages include: 100% foreign ownership, tax exemptions (zero corporate and personal income tax for 10-25 years), duty-free operations, full repatriation of profits, and no currency restrictions.

Is there a minimum capital requirement for company formation in Oman’s Free Zones?

No, in most free zones and for most activities in Oman, there is no minimum capital requirement, which reduces the initial financial burden on investors.

How long does it take to set up a company in Oman’s Free Zones?

The process of company formation in Oman’s Free Zones is relatively fast, typically taking 7 to 10 working days for license issuance once all required documents are submitted.

Do Free Zone companies require a physical office in Oman?

Typically, most free zones in Oman do not require a physical office for initial setup, offering flexibility and lower operational costs for businesses, especially startups.

Do Oman’s Free Zones align with Oman Vision 2040?

Yes, Free Zones play a pivotal role in achieving Oman Vision 2040, as they are designed to attract investments in targeted sectors such as technology, logistics, and manufacturing, aiming to diversify the national economy and enhance its global competitiveness.