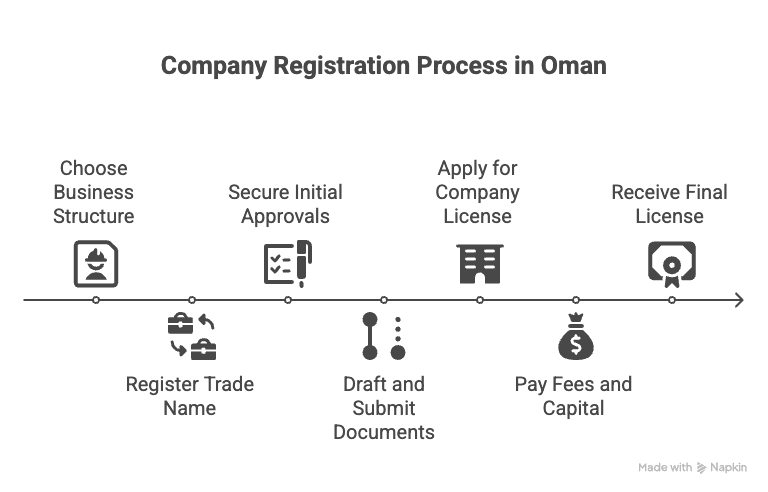

Step-by-Step Licensing Procedures for New Companies in Oman

Are you planning to start a new company in Oman but feel worried about the long list of rules and approvals? Many entrepreneurs and investors find the process confusing and time-consuming.

They fear hidden costs, unclear paperwork, and frequent delays, which often stop them from moving forward. At Jitendra Consulting Group, we guide investors through clear steps and proven methods, making business licensing in Oman less stressful and more predictable.

The Realities of Registering a Business in Oman

Company registration in Oman has become smoother over the past few years because the government encourages foreign investment. The steps may look simple on paper, but each stage demands accuracy and timely compliance.

Missing one document or approval can slow down the process for weeks. The government is also reshaping policies under Oman Vision 2040, making the system more digital and transparent. Investors must understand this shift before moving ahead with a step-by-step company setup in Oman.

1. Choosing the Suitable Business Structure

Your first decision will be the business structure. It determines liability, tax treatment, and future expansion. Entrepreneurs may register as a limited liability company, joint stock company, branch office, or sole establishment.

Each type has different requirements and costs. Picking the wrong structure can lead to legal and financial trouble later. A limited liability company is the most common option as it balances control and protection. Careful selection at this stage saves both time and money.

2. Registering the Trade Name

After defining the structure, the next step is to register the company name. The Ministry of Commerce, Industry, and Investment Promotion (MoCIIP) manages this process. The name must be unique, not similar to existing firms, and aligned with Omani naming rules.

A properly approved trade name becomes your brand identity in official records. Delays usually happen when investors choose names that do not follow the set guidelines. Taking professional advice can reduce rejection chances.

3. Securing Initial Approvals

Before drafting documents, companies must obtain initial approvals. These approvals differ depending on the type of activity. For instance, a construction firm may need clearances from municipal authorities while a medical company may require health ministry approval.

Such clearances ensure that your activities match Oman’s laws. Entrepreneurs often find this step slow due to multiple departments. However, once granted, these approvals give confidence that the project can proceed without legal hurdles.

4. Drafting And Submitting Documents

This stage includes preparing the Articles of Association and other incorporation papers. These documents outline ownership, roles, capital, and management responsibilities. Investors must submit them to MoCIIP for review.

A minor error in drafting can lead to rejection, which delays the licensing journey. Many firms prefer legal and business consultants to avoid such mistakes. Submitting proper documents shows the seriousness of investors and creates smoother approval pathways.

5. Applying For The Oman Company License

Once the papers are in place, you apply for the actual business license. Known as the Oman company license, this approval gives you legal authority to operate in the country. Investors must declare their activity type and location before license approval.

The government is also using more online systems, making applications faster than before. With the Golden Visa programme starting in August 2025, investors will see added benefits like long-term residency and easier business ownership rights.

6. Paying Government Fees And Capital

Licensing also requires payment of government charges and fulfillment of minimum capital requirements. These vary based on the business structure and sector. Foreign-owned companies often have higher fees compared to local firms.

Payment confirms your commitment and secures the processing of your license. Investors should prepare their budgets in advance because sudden financial pressure at this stage can delay final approvals.

7. Receiving The Final Licence

After payments and checks, the authority issues the final licence. This licence allows you to start operations in Oman legally. Many investors feel this as the turning point where their plans finally take shape.

But the process does not end here. There are more registrations and compliance steps to handle. Ignoring them can still risk penalties or suspension.

Post-Licensing Essentials

After licensing, every company must complete the following tasks:

- Register with the Oman Chamber of Commerce and Industry (OCCI)

- Enrol for tax registration with the Oman Tax Authority

- Open files with the Ministry of Labour for employee hiring

- Set up social insurance for staff compliance

- Maintain regular reporting and annual filings

These steps secure your standing as a legitimate entity in Oman and build trust with regulators and clients.

How Jitendra Consulting Group Supports Investors

Jitendra Consulting Group has been helping foreign investors with company formation in Oman for years. Our team assists in selecting the right business structure, preparing documents, applying for the Oman business licence, and handling post-licensing compliance.

With upcoming changes like the Golden Visa programme from August 2025, we guide clients on how to combine residency benefits with business goals. Our Oman business setup guide is tailored for SMEs, corporates, and entrepreneurs who want a smooth entry into the market. We ensure every stage of the company setup in Oman is explicit, lawful, and efficient.

Your business deserves a strong start. Start it with us.

Frequently Asked Questions (FAQs)

What are the procedures for registering a company in the Sultanate of Oman?

The procedures for registering a company in the Sultanate of Oman are carried out through several key steps:

- Choosing the Legal Structure: Determine the company type (Limited Liability Company, Sole Establishment, Branch Office, etc.).

- Reserving the Trade Name: Verify the availability of the trade name and register it with the Ministry of Commerce, Industry, and Investment Promotion (MoCIIP).

- Obtaining Initial Approvals: Get any necessary approvals from relevant government bodies, depending on the company’s activity (e.g., Ministry of Health or Municipality).

- Preparing Documents: Draft the Memorandum of Association and other legal documents.

- Submitting the Application: Submit the documents through the “Invest Easy” electronic portal.

- Paying Fees: Pay the registration fees and the required capital.

- Receiving the License: Receive the final commercial license and the Commercial Registration (CR).

How much does a commercial license cost in Oman?

The cost of a commercial license in Oman varies based on several factors, including the type of business activity, the company’s legal structure, and the required capital. Costs typically include trade name registration fees, commercial registration fees, and additional approval fees. The costs can range from hundreds to thousands of Omani Rials, depending on the nature of your business.

What are the steps to start a project in the Sultanate of Oman?

The steps to start a project in Oman are the same as the company registration steps, and they include:

- Financial and Legal Planning: Prepare a business plan and determine the most suitable legal structure.

- Defining the Activity: Choose the commercial activities your company will undertake.

- Licensing: Follow the licensing procedures mentioned above.

- Registration: Register with the Oman Chamber of Commerce and Industry, the Tax Authority, and the Ministry of Labour.

- Operations: Open a corporate bank account and begin hiring.

What are the types of commercial registration in the Sultanate of Oman?

The types of commercial registration in the Sultanate of Oman include the following legal structures:

- Limited Liability Company (LLC): The most common for small and medium-sized enterprises.

- Public (SAOG) and Private (SAOC) Joint Stock Company: For large corporations that issue shares.

- Sole Establishment: Owned by one person only.

- General Partnership: A partnership between two or more people.

- Representative or Branch Office: An extension of a foreign company.

What are the fees for renewing a commercial license?

The fees for renewing a commercial license in Oman depend on the type of company and the business activity. These fees are paid annually to maintain the validity of the commercial registration. These fees are usually fixed and announced by the Ministry of Commerce, but you should check the Ministry’s “Invest Easy” website for the latest, accurate information on renewal fees.